Introduction

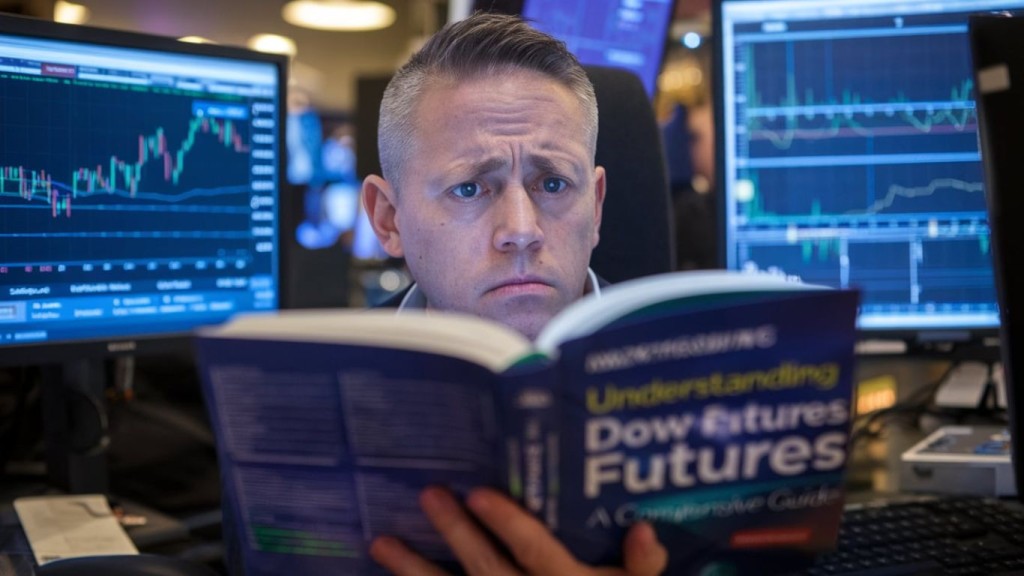

When people talk about the stock market, they often mention the Dow Jones Industrial Average (DJIA), a major benchmark reflecting the performance of 30 large, publicly-owned companies trading on U.S. stock exchanges. But what about Dow Futures? You might have heard this term in financial news or investment discussions. So, what exactly are Dow Futures, and why do they matter?

In this article, we’ll break down everything you need to know about Dow, from their definition to how they work, why they matter, and how investors use them. Whether you’re a curious newbie or someone looking to deepen your understanding, this guide will walk you through all the essential aspects of Dow Futures.

What Are Dow Futures?

Dow Futures are derivative contracts that allow investors to speculate on or hedge against the anticipated future value of the Dow Jones Industrial Average. They allow investors to buy or sell the index at a predetermined price at a specific date in the future. Essentially, they act as a bet on whether the market will rise or fall.

Unlike traditional stock trading, which only occurs during specific hours, Dow can be traded nearly 24/7, providing insights into market sentiment even when the stock market is closed. Traders often use Dow Futures to hedge investments, speculate on market direction, or manage risk.

How Do Dow Futures Work?

Dow operate based on a contractual agreement between two parties. The buyer agrees to purchase the index at a set price, while the seller agrees to sell it at that price on a future date. If the index’s value increases, the buyer profits, while if it decreases, the seller benefits.

These contracts have expiration dates, usually occurring quarterly. However, many traders close their positions before the expiry date to secure profits or limit losses.

Why Are Dow Important?

Dow Futures are important because they provide a sneak peek into market sentiment before the actual stock market opens. For example, if Dow Futures are significantly down in pre-market hours, it’s a strong indication that the DJIA may open lower.

Additionally, they allow investors to protect their portfolios from potential losses by hedging against adverse market movements. For speculative traders, Dow Futures offer opportunities to profit from short-term price fluctuations.

The Role of Leverage in Dow

One of the defining features of Dow is the use of leverage. Leverage allows traders to control a large contract value with a relatively small investment. While this amplifies potential gains, it also increases the risk of substantial losses.

For instance, if you invest $1,000 with a leverage ratio of 10:1, you effectively control $10,000 worth of Dow. However, if the market moves against you by just 10%, your entire investment can be wiped out.

How to Trade Dow Futures

Trading Dow Futures involves opening an account with a brokerage firm that offers futures trading. The steps generally include:

- Selecting a Broker: Ensure they provide access to futures markets.

- Understanding Margin Requirements: Brokers often require a minimum margin deposit to open positions.

- Placing Orders: Decide whether you want to go long (buy) or short (sell) based on your market prediction.

- Monitoring Your Position: Continuously track market trends and news to manage your investments effectively.

- Closing Your Position: This can be done by taking an opposite position or waiting until the contract expires.

Benefits of Trading Dow Futures

- Market Insight: Provides information about likely market direction before it opens.

- Hedging: Investors can protect their portfolios against market downturns.

- High Liquidity: Easy to enter and exit trades due to high trading volumes.

- Leverage: Potentially higher profits with a smaller investment.

Risks Associated with Dow

- Leverage Risks: Amplified losses when trades go wrong.

- Market Volatility: Price movements can be rapid and unpredictable.

- Margin Calls: If your account balance falls below a certain level, brokers may force you to add more funds or close your position.

- Limited Knowledge: New traders may struggle to understand the complexities of trading.

Comparing Dow Futures to Other Market Instruments

Dow Futures differ from options, ETFs, and traditional stocks. While options provide the right but not the obligation to buy or sell, contracts require fulfillment of the agreement. Additionally, trading involves higher leverage and potentially greater risks compared to ETFs and stocks.

Strategies for Trading Dow

Successful Dow trading often involves:

- Technical Analysis: Studying charts, trends, and patterns.

- Fundamental Analysis: Considering economic indicators and company reports.

- Scalping and Day Trading: Making quick, short-term trades for profit.

- Hedging: Protecting existing investments by taking opposite positions.

FAQs

-

What time do Dow start trading?

- Dow trade nearly 24 hours a day from Sunday evening to Friday evening.

-

How are Dow Futures calculated?

- They are derived from the underlying value of the Dow Jones Industrial Average using a multiplier.

-

Can I trade Dow with a small amount of money?

- Yes, but the use of leverage means that losses can exceed your initial investment.

-

What affects Dow prices?

- Economic reports, geopolitical events, interest rate changes, and corporate earnings can all influence prices.

-

Is trading Dow risky?

- Yes, especially due to leverage and market volatility. Understanding the risks is essential before trading.

Conclusion

Dow Futures offer a unique avenue for both novice and experienced investors. Whether used for speculation or hedging, understanding how they work and the risks involved is essential. As with any investment, it’s crucial to have a solid strategy and stay informed.